A tiny cannabis seed is full of potential. As a seed-to-sale business owner, you see its future. First a flowering plant, then a harvested crop, turned into one of thousands of products, and finally placed into the hands of a happy customer.

Having a hand in every step of the journey requires foresight, dedication, and a relentless commitment to your customer.

It’s a rewarding career – but with reward comes risk. With the right insurance and risk management plan, you can protect your business, employees, and customers.

In this guide, we’ll cover:

- Why cannabis businesses need insurance

- What are seed-to-sale cannabis businesses?

- Insurance strategies for seed-to-sale

- Managing risk through the seed-to-sale process

- Choosing a risk partner that understands your seed-to-sale business

Why seed-to-sale cannabis businesses need insurance

Like most businesses, seed-to-sale cannabis businesses need insurance to protect them from financial, legal, and reputational risks.

It’s not just about your run-of-the-mill business risk, though. Seed-to-sale companies face a variety of potential risks unique to the evolving hemp industry. Businesses without a thoughtful integrated risk management program could suffer setbacks from events like:

- Serious property loss

- Regulatory changes

- Product liability

- Employment law-related allegations

- Data breaches

Insurance can help you safeguard your assets and mitigate potential liabilities.

What are seed-to-sale cannabis businesses?

“Seed to sale” is the lifecycle of the marijuana plant from the moment the seed is planted until the final product is in the customer’s hands.

Today, startups and larger companies alike are exploring the benefits of vertical integration in the cannabis space.

The seed-to-sale process

In general, the steps in the seed-to-sale process are:

- Cultivation and grow operations

- Processing and product manufacturing

- Testing facilities

- Delivery and transport

- Dispensaries and retailers

In a traditional model, a company would specialize in one of these areas, forming business partnerships with other specialized organizations to help the plant on its journey from cultivation to distribution.

By controlling more of these steps, businesses can improve efficiency, increase profitability, and exercise better control over quality and customer experience.

Insurance strategies for seed-to-sale

We work with clients in the cannabis industry every day. We’ve learned that while seed-to-sale businesses have a lot on their plate, they’re not always doing everything at once.

Seasonality ebbs and flows in cultivation and infused product manufacturing. Plus, startups often go through a long “ramp-up” period, strategically adding new capabilities until they reach seed-to-sale or full capacity status. Even if you have a license to operate in one area (e.g. lab testing), it might be years before you’re doing the work that exposes you to the associated risks.

It’s a dynamic business model that requires a dynamic insurance strategy. At POWERS, we understand it well. When you partner with us, you’ll have a dedicated risk manager specializing in the cannabis industry.

Have a license to grow but not actively growing at the moment? You shouldn’t be paying for crop coverage. We’ll help make sure you have all the insurance coverage you need – and none you don’t.

Managing risk through the seed-to-sale process

Because the cannabis industry is new and best practices are still evolving, risk management is complex for a business at any step in the supply chain. Seed-to-sale organizations have the challenging task of tackling risk at multiple – or all – steps.

Let’s take a look at common risks throughout the process and how to mitigate them with risk management strategies and cannabis insurance products.

Cultivation and grow operations

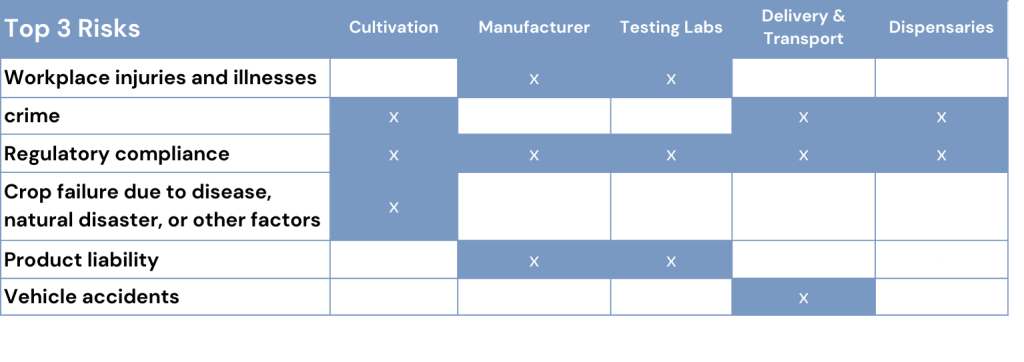

Top risks:

- Crop failure due to disease, natural disaster, or other factors

- Workplace injuries

- Regulatory compliance

- Crime

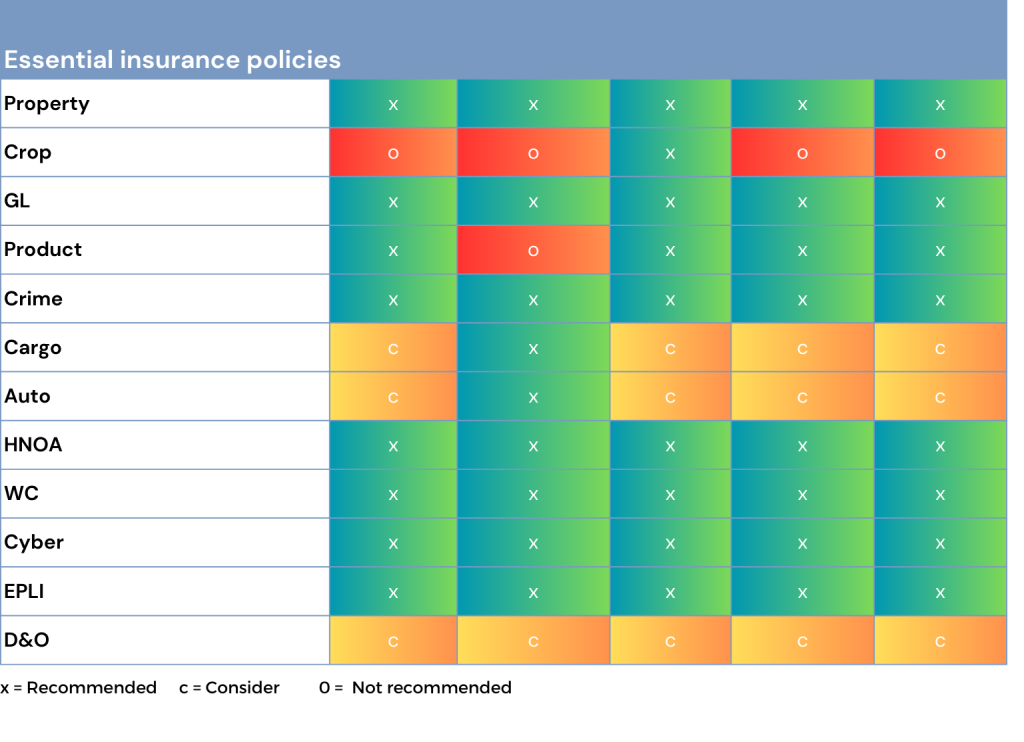

Essential insurance policies:

- General liability insurance

- Workers’ comp insurance

- Crop insurance

- Commercial property insurance

- Crime insurance

For more, check out Cannabis Cultivation Insurance: A Business Owner’s Guide.

Processing and product manufacturing

Top risks:

- Product liability

- Workplace injuries

- Regulatory compliance

Essential insurance policies:

- General liability insurance

- Workers’ comp insurance

- Commercial property insurance

- Product liability insurance

For more, check out Cannabis Product Manufacturer Insurance: A Business Owner’s Guide.

Testing facilities

Top risks:

- Professional liability

- Workplace injuries and illnesses

- Regulatory compliance

Essential insurance policies:

- General liability insurance

- Workers’ comp insurance

- Commercial property insurance

- Professional liability (E&O insurance)

For more, check out Cannabis Testing Lab Insurance: A Business Owner’s Guide.

Delivery and transport

Top risks:

- Vehicle accidents

- Crime

- Regulatory compliance

Essential insurance policies:

- General liability insurance

- Workers’ comp insurance

- Commercial property insurance

- Commercial auto insurance

- Inland marine insurance

- Crime insurance

For more, check out Cannabis Delivery and Transport Insurance: A Business Owner’s Guide.

Dispensaries and retailers

Top risks:

- Product liability

- Crime

- Regulatory compliance

Essential insurance policies:

- General liability insurance

- Workers’ comp insurance

- Commercial property insurance

- Product liability insurance

- Crime insurance

For more, check out Dispensary Insurance: A Cannabis Business Owner’s Guide.

Choosing a risk partner that understands your seed-to-sale business

To protect the business you’ve worked hard to build, insurance alone is not enough. It’s crucial to identify the most critical threats and make strategic decisions that will allow you to grow your business without disruption.

Cannabis-related businesses face unique challenges. We’re right there with you – we work in the cannabis industry too. We just happen to be on the risk management side.

When you partner with POWERS, we’re more than your insurance agency. We’re a true business partner invested in your success. Our philosophy combines:

Deep Expertise

Battle Tested Processes

Cutting-edge Tools

Genuine care for clients

We put programs in place to help you execute your business plans. It’s all about empowering you to mitigate risk and grow your business. That’s the POWERS Promise.