In 1999, the 45-story crane nicknamed “Big Blue” collapsed during the construction of the Miller Park baseball stadium in Milwaukee. The incident caused $100 million in damage to the project and three workers were killed.

The park district had a builder’s risk property insurance program and the repair costs were covered by several insurance carriers and policies.

Builder’s risk insurance protects your business in scenarios like this one where damage occurs while a project is in progress. Who needs a builder’s risk policy and what does it cover?

In this guide, we’ll explore:

- What is builder’s risk insurance?

- What does builder’s risk cover?

- Who needs builder’s risk insurance?

- How much does a builder’s risk policy cost?

- How safety programs impact your builder’s risk insurance

- How to get builder’s risk coverage

- The builder’s risk claim process: What to expect

- Get the builder’s risk coverage you need from a partner you trust

What is builder’s risk insurance?

Builder’s risk insurance, sometimes called course of construction (COC) insurance, is a specialized type of property insurance that covers damages or losses to a construction project during its construction or renovation phase. It protects the business owner, contractor, or property owner from financial losses caused by unexpected events or perils during the construction process.

What does builder’s risk cover?

Your builder’s risk insurance policy covers a range of perils, including fire, theft, vandalism, windstorms, lightning, explosions, and some natural disasters. It typically provides protection for:

- Structures under construction

- Temporary structures

- Building materials

- Equipment

- Supplies

- Soft costs, like architect fees and permits

What is not covered by builder’s risk?

Your builder’s risk policy likely will not cover:

- Liability for injuries or damage is typically covered by general liability insurance

- Design or planning errors likely covered by errors and omissions insurance

- Inadequate workmanship

- Losses caused by earthquakes, floods, or acts of terrorism

- Intentional damage

What is and isn’t covered can vary, so it’s important to be familiar with your specific policy details. At POWERS, we go through a thorough assessment with all clients to ensure the policies they buy fit the risk they face.

Builder’s risk vs. general liability

Builder’s risk is a type of property insurance that only lasts until the project is complete. It covers the physical property and materials involved in a construction project if they’re damaged by a peril such as a fire.

In contrast, general liability insurance is a type of liability insurance for your ongoing operations. It protects your business if a third party claims that you caused injury or property damage.

Builder’s risk vs. contractors insurance

While builder’s risk insurance protects your project while under construction, the term contractors insurance typically refers to a bundle of policies common for contractors in the construction industry. This might include builder’s risk, but it will also often include general liability, inland marine insurance, workers’ compensation insurance, commercial property insurance, commercial auto insurance, and other coverages based on your operations.

Who needs builder’s risk insurance?

Builder’s risk insurance is essential for anyone involved in a construction project, including business owners, general contractors, subcontractors, and property owners.

Since most construction projects involve all these stakeholders, it’s important to distinguish which party will hold the builder’s risk policy. Most often, the general contractor will purchase the policy. However, contracts sometimes specify other arrangements, like requiring the building owner or buyer to purchase the policy.

Why a builder’s risk policy is important

An event that causes damage to buildings under construction can result in delays in completion, extra expenses to repair the damage, and significant financial losses for all parties involved. Builder’s risk is often required by lenders to help mitigate risks and ensure the successful completion of the project.

How much does a builder’s risk policy cost?

Insurance carriers calculate your builder’s risk premium using several factors, such as:

- Size and value of the project

- Construction materials used

- Location

- Coverage limits

- Duration of the policy

Builder’s risk insurance premiums are often calculated as a percentage of the total construction cost, ranging from around 1 – 5%.

Because insurance rates can vary, it’s important to work with a risk manager to find the best solution. Businesses with complex risk profiles will find the most value from partnering with an independent insurance agent that will help them proactively manage risk for long-term success.

More on the benefits of integrated risk management. >

How safety programs impact your builder’s risk insurance

A strong workplace safety program can reduce your risk of incidents and claims – and therefore, lower your insurance premiums. Working with a safety education expert to develop consistent policies and procedures has a variety of other benefits, too, like:

- Reducing employee and customer injuries

- Reducing property damage from incidents

- Increasing employee retention

- Improving productivity and efficiency

- Boosting your company’s goodwill and reputation

How to get builder’s risk coverage

An experienced agent should recommend insurance policies for you based on your business’s unique exposures and risk profile. If your agent hasn’t recommended builder’s risk but you think it could be a good fit, ask about it.

Your agent will find the best options based on your risk assessment and present them to you. At POWERS, we cover the following questions when presenting clients with coverage options:

- Does the pricing match the client’s expectations?

- Does the policy have the appropriate limits, deductibles, and coverage enhancement endorsements?

- What are the carrier’s financial stability, reputation, and claims process like?

- What added value can the carrier offer the client – e.g. compliance support and claims management?

At POWERS, we work with some of the best business insurance carriers in the U.S. There’s no need to spend hours researching providers – we’ll make recommendations tailored to your business.

I truly believe these guys are looking out for your best interest and have complete faith and trust in the care they put into what they do for you, researching rates, getting the best coverage for you.

Kraig H. (current client)

The builder’s risk claim process: What to expect

If you need to file a builder’s risk claim, don’t panic. Thousands of claims are filed every day.

The claim process is different for every carrier and agency, so we recommend learning your insurance agent’s process before you need to file a claim. That way, you’re prepared when the time comes.

Here’s the claim process for POWERS clients:

- Contact your POWERS account manager or claims handler before you call the insurance carrier.

- A POWERS expert will provide a claim consultation to help you evaluate the severity of the claim, your deductible level, contractor referrals, and what to expect going forward.

- With your approval, your account manager will submit the claim to the carrier on your behalf. In some cases, you might choose not to file a claim.

- We’ll pass along your claim number and your adjuster’s contact info.

- You’ll work directly with your adjuster to provide relevant evidence, like photos of the damage, construction plans, invoices, and contracts.

- If the loss is covered, the carrier will offer a settlement amount based on its evaluation of the damage.

- Once a settlement is reached, the carrier will provide payment.

During this process, your POWERS claims consultant will be with you every step of the way.

Get the builder’s risk coverage you need from a partner you trust

Many construction businesses can benefit from a builder’s risk policy, but how can you make sure you get the right coverage and the most value from your policy? Who will guide you through the claims process when an incident happens?

Any agent can write you a policy. But you don’t need any agent – you need a business partner with proven risk control expertise.

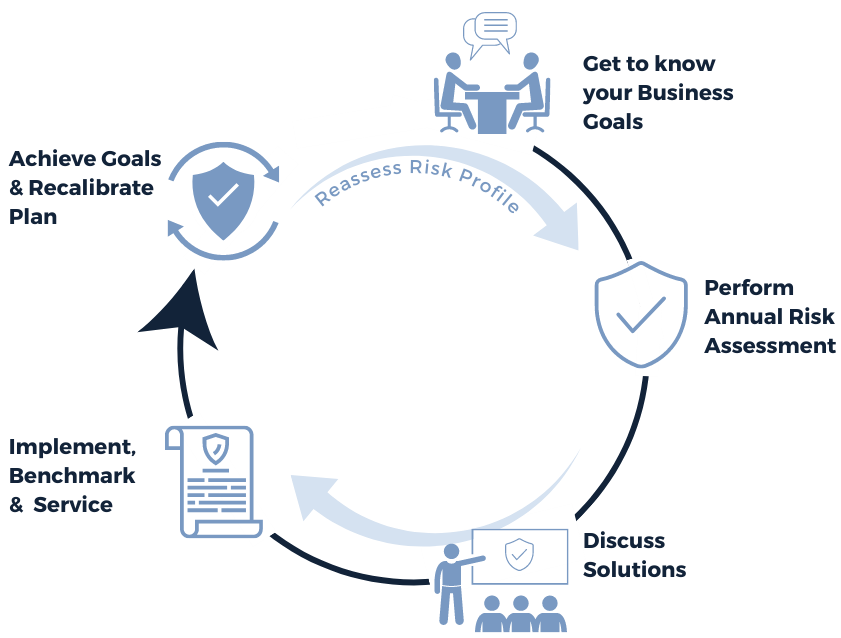

At POWERS, we spent more than 30 years developing what we call “the POWERS Process.” We use this five-step framework to get a deep understanding of your business and make recommendations that not only give you the right insurance coverage but also help you make smart decisions to grow your business.

We know from decades of experience that a one-size-fits-all approach to risk management simply doesn’t work. We’ll take you through a series of discussion points to drill down and uncover exposures you’ve never considered. Then, we’ll build a plan to safeguard your business and look toward the future.

Schedule your 30-minute consultation today. >

| Anonymous Agency | POWERS |

| Insurance as a stand-alone product | Insurance integrated into your customized risk management plan |

| Multiple, run-of-the-mill applications to assess your risk | Customized, proprietary assessment for a deep understanding of your risk |

| Focused on up-front cost savings | Focused on long-term cost control |

| Salespeople who write your policy and ghost you until renewal | Partners who help you make smart, growth-focused business decisions |

| Say they care about your business’s success | Show you we care by setting your risk management plan in motion |