In 2021, ready-mix cement manufacturer Argos USA agreed to pay a $20 million criminal penalty to settle antitrust charges. The company admitted that a small number of employees had conspired to fix prices in a local office in the Georgia area.

Management outside the local office did not know about or participate in the activity. However, directors and officers can be held liable for misconduct even if they don’t know about the crime.

Directors’ and officers’ insurance protects executives’ personal assets in scenarios similar to this one. Who needs a D&O insurance policy and what does it cover?

In this guide, we’ll explore:

- What is D&O insurance?

- What does D&O cover?

- Who needs D&O coverage?

- How much does D&O insurance cost?

- How governance programs impact your D&O insurance

- How to get D&O coverage

- The D&O claim process: What to expect

- Get the D&O coverage you need from a partner you trust

What is D&O insurance?

D&O insurance, also known as directors and officers liability insurance, protects the personal assets of directors and officers of a company in the event that they are sued for alleged wrongful acts in their roles as executives. It can provide coverage for legal fees, settlements, and judgments related to covered claims.

What does D&O cover?

Directors and officers insurance can provide coverage for legal costs, settlements, and judgments related to covered claims. It can also cover things like investigation costs, which can be significant even if a claim is ultimately unfounded.

D&O protects individuals from personal liability and financial loss if they are sued for things like breach of fiduciary duty, mismanagement, or other types of alleged wrongdoing.

In addition to protecting the individual directors and officers, D&O insurance can also provide coverage for the company itself, which may be sued in connection with the alleged wrongful acts or omissions of its executives.

What is not covered by D&O?

D&O is a fairly limited type of coverage, and typically doesn’t include:

- Employee claims, such as discrimination and wrongful termination, are typically covered by EPLI

- Bodily injury or property damage addressed by general liability insurance

- Intentional misconduct, unethical business practices, and criminal actions may not be covered

- Prior acts and known circumstances that occurred before policy inception

What is and isn’t covered can vary, so it’s important to be familiar with your specific policy details. At POWERS, we go through a thorough assessment with all clients to ensure the policies they buy fit the risk they face.

D&O vs. E&O (professional liability insurance)

While D&O insurance and E&O insurance both provide coverage for legal fees, settlements, and judgments related to covered claims, the types of claims they cover are fundamentally different.

D&O insurance covers claims related to alleged wrongful acts or omissions by directors and officers in their roles as executives. On the other hand, E&O insurance provides coverage for claims related to alleged professional mistakes or negligence by any employee in the company.

Who needs D&O coverage?

We typically recommend a D&O liability insurance policy for any public or private company that has a board of directors or executive officers. Public companies or businesses seeking funding may have a greater need for D&O insurance, as investors and shareholders often view this type of coverage as a sign of responsible corporate governance and risk management.

D&O for small businesses and nonprofits

While many larger corporations have a directors and officers policy in place, smaller businesses and nonprofit organizations may also benefit from this type of coverage. In fact, smaller organizations may face even greater risks, as they have fewer resources to defend against a lawsuit and are more vulnerable to the financial impact of a settlement or judgment.

Is a D&O policy mandatory?

No, a D&O insurance policy is not legally required, but it might be required for your organization by investors, lenders, the board of directors, or regulatory bodies.

How much does D&O insurance cost?

The cost of D&O insurance depends on several factors, such as:

- Industry and level of risk

- Business size and annual revenue

- Policy limits and deductibles

- Claims history

- Governance and risk management practices

Because insurance rates can vary, it’s important to work with a risk manager to find the best solution. Businesses with complex risk profiles will find the most value from partnering with an independent insurance agent that will help them proactively manage risk for long-term success.

More on the benefits of integrated risk management. >

How governance programs impact your D&O insurance

A strong corporate governance program can have a direct impact on your D&O insurance. Your underwriter will closely evaluate your governance and risk management protocols. Having an effective board structure, transparent decision-making process, and compliance frameworks can demonstrate your commitment to mitigating risk and maintaining ethical conduct.

How to get D&O coverage

An experienced agent should recommend insurance policies for you based on your business’s unique exposures and risk profile. If your agent hasn’t recommended D&O but you think it could be a good fit, ask about it.

Your agent will find the best options based on your risk assessment and present them to you. At POWERS, we cover the following questions when presenting clients with coverage options:

- Does the pricing match the client’s expectations?

- Does the policy have the appropriate limits, deductibles, and coverage enhancement endorsements?

- What are the carrier’s financial stability, reputation, and claims process like?

- What added value can the carrier offer the client – e.g. contract alignment and crisis management support?

At POWERS, we work with some of the best business insurance carriers in the U.S. There’s no need to spend hours researching providers – we’ll make recommendations tailored to your business.

I truly believe these guys are looking out for your best interest and have complete faith and trust in the care they put into what they do for you, researching rates, getting the best coverage for you.

Kraig H. (current client)

The D&O claim process: What to expect

If you need to file a D&O claim, don’t panic. Thousands of claims are filed every day.

The claim process is different for every carrier and agency, so we recommend learning your insurance agent’s process before you need to file a claim. That way, you’re prepared when the time comes.

Here’s the claim process for POWERS clients:

- Contact your POWERS account manager or claims handler before you call the insurance carrier.

- A POWERS expert will provide a claim consultation to help you evaluate the severity of the claim, your deductible level, contractor referrals, and what to expect going forward.

- With your approval, your account manager will submit the claim to the carrier on your behalf. In some cases, you might choose not to file a claim.

- We’ll pass along your claim number and your adjuster’s contact info.

- You’ll work directly with your adjuster to provide relevant evidence, like contracts, agreements, correspondence, board meeting minutes, and financial statements.

- If your claim is covered, the carrier will offer a settlement amount to the claimant or provide a defense if a lawsuit is filed against you.

- The claim will be resolved through a settlement agreement or a court decision.

During this process, your POWERS claims consultant will be with you every step of the way.

Get the D&O coverage you need from a partner you trust

Many businesses can benefit from a directors and officers insurance policy, but how can you make sure you get the right coverage and the most value from your policy? Who will guide you through the claims process when an incident happens?

Any agent can write you a policy. But you don’t need any agent – you need a business partner with proven risk control expertise.

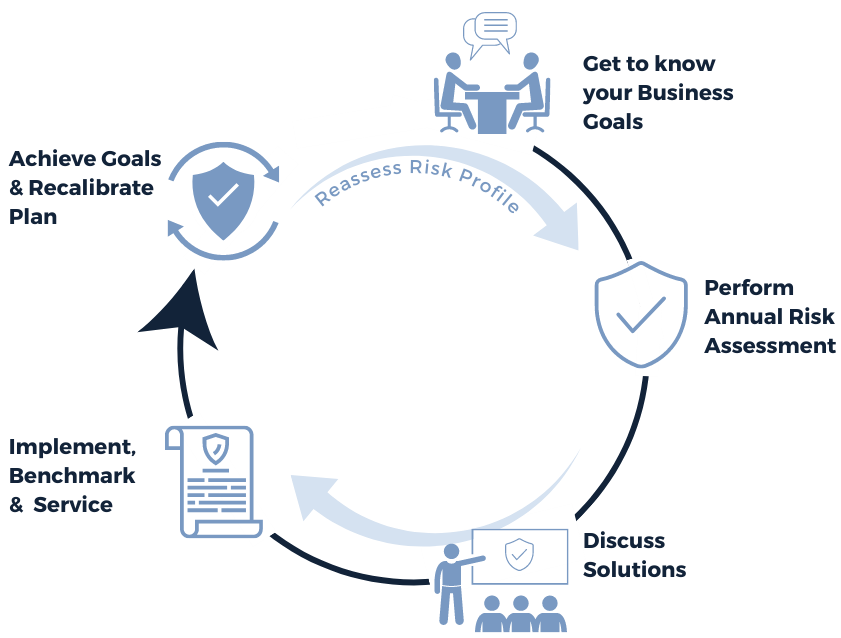

At POWERS, we spent more than 30 years developing what we call “the POWERS Process.” We use this five-step framework to get a deep understanding of your business and make recommendations that not only give you the right insurance coverage, but also help you make smart decisions to grow your business.

We know from decades of experience that a one-size-fits-all approach to risk management simply doesn’t work. We’ll take you through a series of discussion points to drill down and uncover exposures you’ve never considered. Then, we’ll build a plan to safeguard your business and look toward the future.

Schedule your 30-minute consultation today. >

| Anonymous Agency | POWERS |

| Insurance as a stand-alone product | Insurance integrated into your customized risk management plan |

| Multiple, run-of-the-mill applications to assess your risk | Customized, proprietary assessment for a deep understanding of your risk |

| Focused on up-front cost savings | Focused on long-term cost control |

| Salespeople who write your policy and ghost you until renewal | Partners who help you make smart, growth-focused business decisions |

| Say they care about your business’s success | Show you we care by setting your risk management plan in motion |